MrInfinity

DIS Veteran

- Joined

- Aug 23, 2012

- Messages

- 2,577

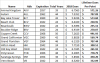

Dues X 50 years= $36,300 plus initial investment of $18,200 so

Total Cash investment is $54,500 over 50 years for 5,000 points

Per point cash "value"= $10.90 per point or $1,090 per year "cash/investment value" so to speak

This example I do not see the value in DVC: tying up $50,000 plus dollars for that low of savings.

Please give me any input you have or accuracy, correctness, etc. Benefits I have missed or if I just missed the entire thing.

Overall I am trying to see the value in tying up so much money over 50 years when the benefits don’t seem to be that substantial.

DVC members: what are the main perks?

My thought is that the biggest perk will be locking in a point cost for resort because once you sign up, they cannot charge more total points for that resort, only reallocate within that resort. BUT, is this lock in offset by increasing annual dues?

You seem to have nailed most of the pros and cons. I'll add a few bits to consider.

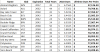

You've come to the same conclusion many do, that the value per point ends up around $11. That is only valid if you'd otherwise store your money in a shoebox. The biggest cost is the value of that money over time. If you have $18,000 now, then at even a modest 5% you could be earning $900 per year toward cash vacations. Add this $900/yr to your $1090/yr (or subtract it from your cash vacation expense) and you'll see the costs are more like $2000/yr, or around $20pp (per point)

That's buying direct. Buying resale, you can get that down to around $15pp... Which... Coincidentally is what Disney will sell you one-time-use points for.

Another way to think about it is like this. If you had $18k 50 years ago and you diversified it among strong companies that are still around today... You would now be wealthy. On the other hand if you'd bought a timeshare, you'd now own a $0-value timeshare and have no cash.

You also seem (IMO) to be pegging the cash prices high. We stay in Deluxes and have never paid $505 a night. We paid more like $330-$450. Consider discounts and other savings methods you'd use on a cash room that don't apply to DVC.

Given this, you'd already come to the conclusion that DVC wasn't a great deal even with undervaluing the costs and overstating the cost of staying hotel-side. And with the modifications above you'll find that buying direct is not likely to save you at all... and buying resale you'll save maybe a little but it's tight.

Why buy then? Well if you only need Studios, it's tough. You can stay in a hotel for about the same cost, but with total flexibility. But we have outgrown hotels and studios, and when you enter that realm of needing the 2-Bedroom or larger units, DVC starts to shine financially. Larger suites at the World can be 3x-4x the cost of a regular room... But 2B's are only about 2x the cost of a Studio. There is a bigger savings when you want to take your family of 6+ and stay in one room.

There is also the emotional side. You've got $18k to enjoy, so you can buy anything -- a timeshare that you'll use for life is a perfectly good thing to buy. We love ours. It gives us access to many stay options at Disney World that we wouldn't have otherwise. You'll take more vacations over the long run and that's a good thing!

Last edited:

Bill

Bill