superlarz

DIS Veteran

- Joined

- Aug 28, 2013

- Messages

- 713

I stayed in a 1br last week and can say that i wholeheartedly agreeSo lovely! You’ll love your tour. I could move into the 1 bedroom

I stayed in a 1br last week and can say that i wholeheartedly agreeSo lovely! You’ll love your tour. I could move into the 1 bedroom

Did you use the dishwasher?I stayed in a 1br last week and can say that i wholeheartedly agree

I did not personally load or start the dishwasher but members of my party did use itDid you use the dishwasher?

When you mention VGC sales, I assume you mean direct sales? If yes, I wonder how the buyers were able to get a hold of them. Is DVC clearing out the (many) years long wait list?Monthly update!

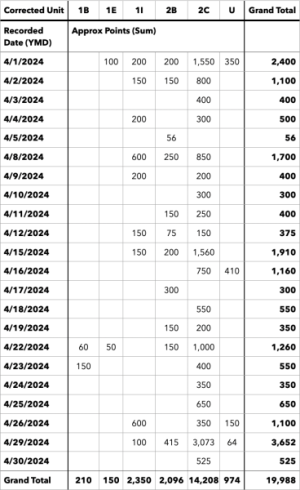

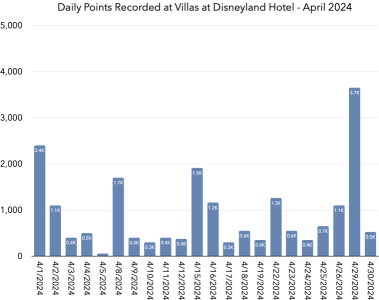

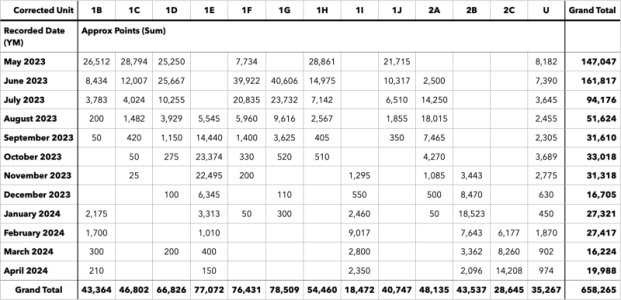

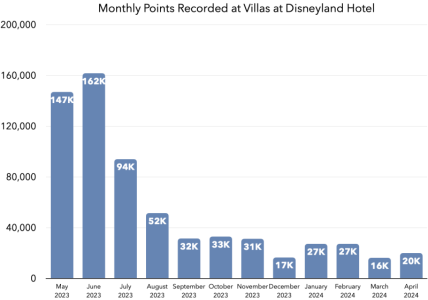

Total points recorded as of April 30th: ~658k points (20.2% of all points).

Points recorded in April: ~20.0k points.

...

Something I noted last three months but continues to be a thorn to sales monitoring is a change OCRW made. Previously, OCRW would publish the Lot Number, the Transfer Tax Amount, and the Unit #. Now they just post Transfer Tax and Unit #, making it harder to differentiate VGC sales from VDH (which have different lot numbers). Yes, DVC has been selling a trickle of VGC this entire time.

In fact, while I haven't been tracking VGC sales I think there's actually been an uptick in the sales rate (or at least I feel like I'm deleting more spreadsheet rows as being more-likely-VGC-than-not).

...

I'll do my best to take educated guesses on the contract size, but there have definitely been some challenges.

Luck of the draw based on your guide activity looking for them.This is amazing info, especially with the challenges of categorizing the different sales. Thanks for all this!

When you mention VGC sales, I assume you mean direct sales? If yes, I wonder how the buyers were able to get a hold of them. Is DVC clearing out the (many) years long wait list?

Yep, direct VGC sales!This is amazing info, especially with the challenges of categorizing the different sales. Thanks for all this!

When you mention VGC sales, I assume you mean direct sales? If yes, I wonder how the buyers were able to get a hold of them. Is DVC clearing out the (many) years long wait list?

I am surprised that they didn’t declare all of the villas (including Grand) since there are so few of them to begin with.Yep, direct VGC sales!

Tracking resale on the OCRW site is borderline impossible due to the mediocre search/filtering functionality.

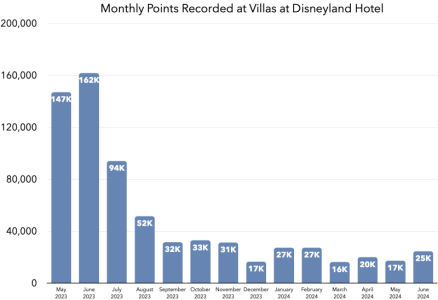

A brief year in review:

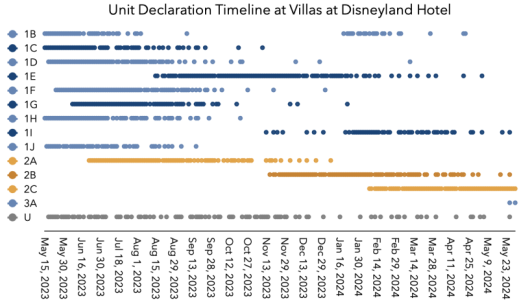

- Contracts started showing up in OCRW on May 15, 2023

- Through May 14, 2024 (a year), there have been approximately 666.3k points recorded in OCRW

- This is ~20.5% of the total resort

- Actual 'first year' sales are a bit higher due to delayed closings

- 727k points, a little over 22% of the resort, had been declared in the first two declarations (#1 prior to sales and #2 in very early sales)

- A third declaration just appeared prior to the 1yr anniversary, on May 9, 2024. I don't know (yet?) how much has been declared

- Initial sales were extremely hot:

- The peak 4-week rate was ~178k per 4 weeks. At that rate, VDH would have sold out in 1.4 years, or just a few months from now

- One of those 4 weeks had just 7k points recorded...if just the peak week rate had been sustained VDH would have sold out a month ago

- VDH had 12 individual days where more points were recorded than CFW's first full month

- IIRC, during an earnings call Iger or the CFO shared that VDH set an initial sales record

- The current sales rate is much lower, on track to sell out in more like 10 years

- (as an aside, so far May 2024 is not helping that...)

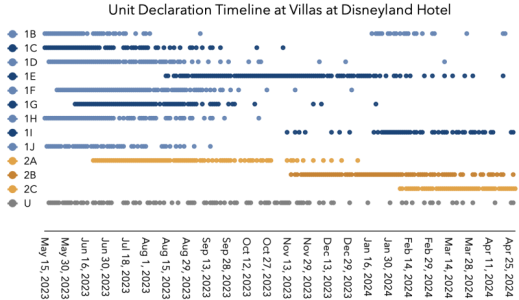

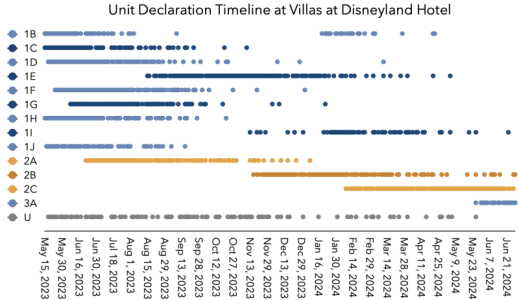

- Almost all Units in Units 1x and 2x are in the 'sell out' range, except 1A, 1I (one eye), and 2C

- There's a lot of delayed closings! Even with the base price increase on Feb 1, ~25% of the contracts recorded in April appeared to be sold using the pre-increase base price

- If I'm interpreting OCRW correctly, about 50-60% of contracts have been financed through Disney

- The non-accessible Grand Villa still isn't bookable with points, due to limited declarations

- 150pts has been the most popular contract size, by far, with 1460 deeds recorded, or about 33% of all deeds

- 50pts has been the 2nd most popular, with 695 deeds (15.5% of deeds)

- 1,500pts is the largest deed sold so far, and there have been 2 of them!

- And this is despite the Grand Villas being ineligible for any Favorite Weeks due to only 2 being built

- Favorite Weeks are selling, I see what appear to be a few each month (though I cannot confirm...)

- This has been a fun journey, I'm going to continue with monthly and ad hoc reporting, thanks for reading!

Wonderful analysis as always ehh! Enjoyed reading.Monthly update!

Total points recorded as of May 31st: ~678k points (20.75% of all points).

Points recorded in May: ~17.3k points.

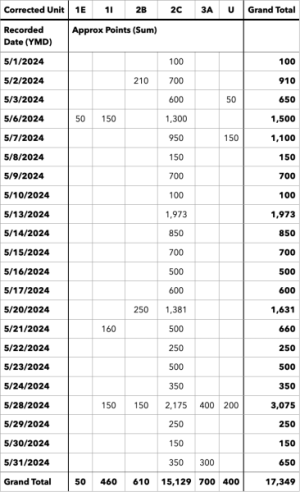

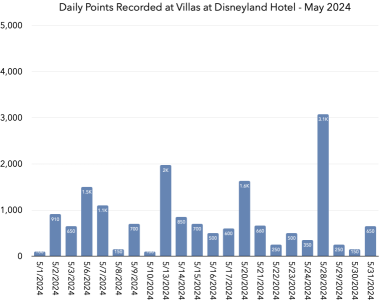

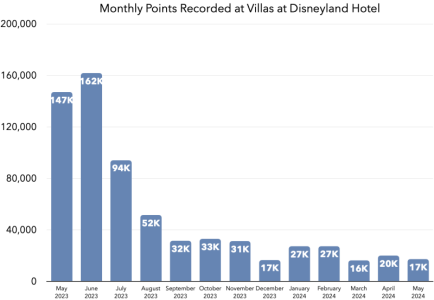

A little over 17k points recorded in May, 17,349 by my estimates. Third lowest month by points, but a new low for the number of contracts (104).

Despite prices going up to $239/pt on Feb 1, still seeing a trickle of $230/pt contracts being recorded in May, with 5 of the 104 deeds being more likely to be $230 rather than $239, based on the recording tax paid. Oddly, there was a contract with $0 tax paid (at least that's what was recorded), and I'm not sure what to make of it.

At the current rate, VDH will sell out in a whopping 148 months, or 12.4 years from now...that's late 2036!

The April 1 price/incentive updates were our first indications that maybe DVD wants to pick up the pace a bit as 200+ point contracts are now available below pre-sales pricing, as long as you qualify for the Welcome Home incentive, but there wasn't a statistically-confident uptick in larger contracts in April. I think that changed in May, with a decent bump in 200+ pt contracts compared to March (similar number of contracts).

As of April 30th, ~22.3% of points were declared and at least ~20.8% of the resort has now been sold. It appears that DVD took the plunge on May 9 to declare more points, though I don't have the declaration details at this time (due to laziness...the process to mail a check to OCRW is too much for my millenial brain). Because I don't know what's part of the most recent declaration, I don't know how much breathing room they have before declaring more units currently.

The apparent declaration on May 9th is supported by the first Unit 3A deeds showing up on May 28.

As a reminder, I'm just doing ad hoc and monthly updates now.

Fun facts about May's sales:

Very few fun facts this month...May 2024 might be the most boring month yet! Largest contract was just 350 points and there was only one FW candidate: a 222-223pt contract that is likely a 222pt FW for W51 or W52 at a SV Deluxe Studio.

The most interesting things were the appearance of Unit 3A and a $0 tax contract (implying 0 points...).

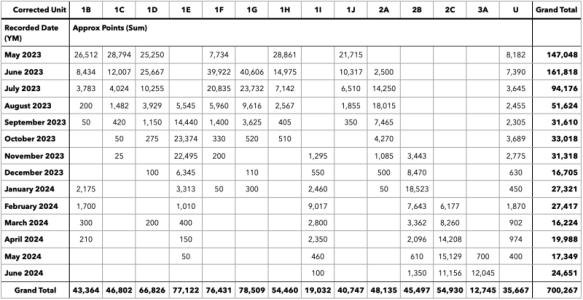

Unit 2C was the top seller again, with over 85% of this month's points. I think all 1x and 2x Units, except 1A, have now appeared in recorded contracts. Unit 2B sales fell off to third place while 3A came in 2nd this month. There was also one 1E contract recorded this month.

It is likely that a bunch of Units are now sold out: 1B, 1C, 1D, 1F, 1G, 1H, 1J, 2A, and 2B. We still haven't seen 1A show up in any recorded deeds yet.

Other interesting facts about the contracts recorded in May:

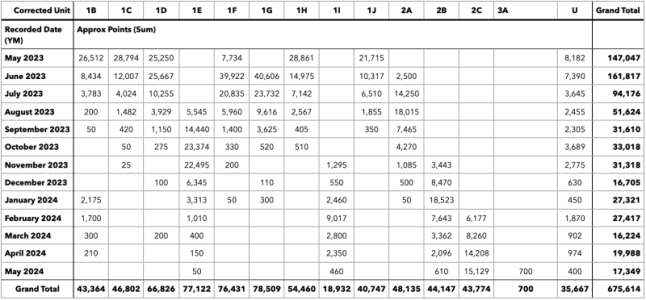

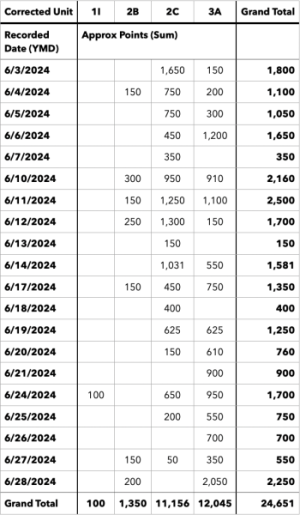

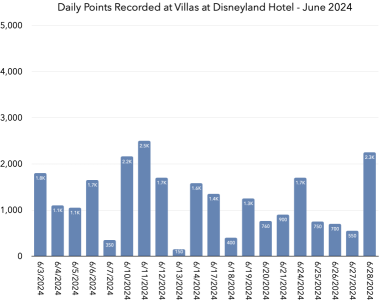

Points recorded by date:

- 104 contracts recorded

- 40x 150pt contracts (41 the prior month)

- 25x 200pt contracts (21 the prior month)

- 9x 50pt contracts (16 the prior month)

- 8x 100pt contracts (12 the prior month)

- 7x 300pt contracts (9 the prior month)

- 7x 250pt contracts (6 the prior month)

- 8x other contracts (15 the prior month)

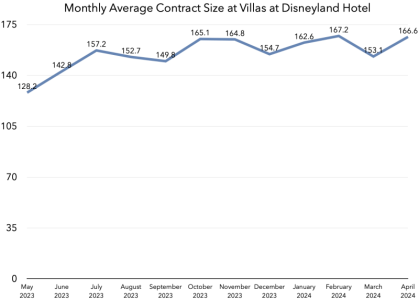

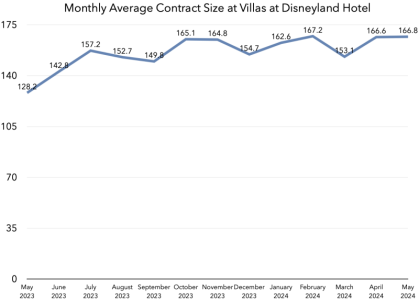

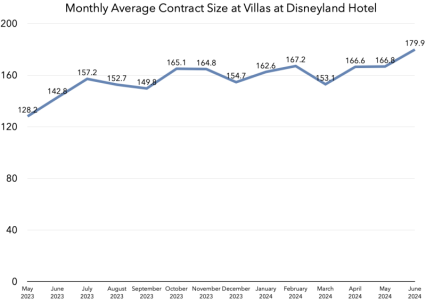

- 166.8pt average contract size in May

- May had an average of 128.2pt

- June had an average of 142.8pt

- July had an average of 157.2pt

- August had an average of 152.7pt

- September had an average of 149.8pt

- October had an average of 165.1pt

- November had an average of 164.8pt

- December had an average of 154.7pt

- January 2024 had an average of 162.6pt

- February 2024 had an average of 167.2pt, highest ever

- March 2024 had an average of 153.1pt

- April 2024 had an average of 166.6pt

- 350pt is largest contract in May (1x)

- 50pt is smallest contract

- 300pt is the largest contract size purchased multiple times (7x)

- Unit 2C was assigned the most (15.1k, 2nd most was 3A at 700)

View attachment 868730

"U" unit stands for "Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

View attachment 868732

Points recorded by month:

View attachment 868733

View attachment 868734

View attachment 868735

View attachment 868736

Monthly update!

Total points recorded as of May 31st: ~678k points (20.75% of all points).

Points recorded in May: ~17.3k points.

A little over 17k points recorded in May, 17,349 by my estimates. Third lowest month by points, but a new low for the number of contracts (104).

Despite prices going up to $239/pt on Feb 1, still seeing a trickle of $230/pt contracts being recorded in May, with 5 of the 104 deeds being more likely to be $230 rather than $239, based on the recording tax paid. Oddly, there was a contract with $0 tax paid (at least that's what was recorded), and I'm not sure what to make of it.

At the current rate, VDH will sell out in a whopping 148 months, or 12.4 years from now...that's late 2036!

The April 1 price/incentive updates were our first indications that maybe DVD wants to pick up the pace a bit as 200+ point contracts are now available below pre-sales pricing, as long as you qualify for the Welcome Home incentive, but there wasn't a statistically-confident uptick in larger contracts in April. I think that changed in May, with a decent bump in 200+ pt contracts compared to March (similar number of contracts).

As of April 30th, ~22.3% of points were declared and at least ~20.8% of the resort has now been sold. It appears that DVD took the plunge on May 9 to declare more points, though I don't have the declaration details at this time (due to laziness...the process to mail a check to OCRW is too much for my millenial brain). Because I don't know what's part of the most recent declaration, I don't know how much breathing room they have before declaring more units currently.

The apparent declaration on May 9th is supported by the first Unit 3A deeds showing up on May 28.

As a reminder, I'm just doing ad hoc and monthly updates now.

Fun facts about May's sales:

Very few fun facts this month...May 2024 might be the most boring month yet! Largest contract was just 350 points and there was only one FW candidate: a 222-223pt contract that is likely a 222pt FW for W51 or W52 at a SV Deluxe Studio.

The most interesting things were the appearance of Unit 3A and a $0 tax contract (implying 0 points...).

Unit 2C was the top seller again, with over 85% of this month's points. I think all 1x and 2x Units, except 1A, have now appeared in recorded contracts. Unit 2B sales fell off to third place while 3A came in 2nd this month. There was also one 1E contract recorded this month.

It is likely that a bunch of Units are now sold out: 1B, 1C, 1D, 1F, 1G, 1H, 1J, 2A, and 2B. We still haven't seen 1A show up in any recorded deeds yet.

Other interesting facts about the contracts recorded in May:

Points recorded by date:

- 104 contracts recorded

- 40x 150pt contracts (41 the prior month)

- 25x 200pt contracts (21 the prior month)

- 9x 50pt contracts (16 the prior month)

- 8x 100pt contracts (12 the prior month)

- 7x 300pt contracts (9 the prior month)

- 7x 250pt contracts (6 the prior month)

- 8x other contracts (15 the prior month)

- 166.8pt average contract size in May

- May had an average of 128.2pt

- June had an average of 142.8pt

- July had an average of 157.2pt

- August had an average of 152.7pt

- September had an average of 149.8pt

- October had an average of 165.1pt

- November had an average of 164.8pt

- December had an average of 154.7pt

- January 2024 had an average of 162.6pt

- February 2024 had an average of 167.2pt, highest ever

- March 2024 had an average of 153.1pt

- April 2024 had an average of 166.6pt

- 350pt is largest contract in May (1x)

- 50pt is smallest contract

- 300pt is the largest contract size purchased multiple times (7x)

- Unit 2C was assigned the most (15.1k, 2nd most was 3A at 700)

View attachment 868730

"U" unit stands for "Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

View attachment 868732

Points recorded by month:

View attachment 868733

View attachment 868734

View attachment 868735

View attachment 868736

Me wondering if these 15 people realized 250pts is the same cost per point as 200.15x 250pt contracts (7 the prior month)

And someone bought 150 points split across 70pt and 80pt contracts...which child do they like 14% more?!