kdonnel

DVC-BCV

- Joined

- Feb 1, 2001

- Messages

- 7,042

Almost 5 years ago I switched from Allstate to Horace Mann and saved $1000 a year on homeowners and $3000 a year on car insurance.

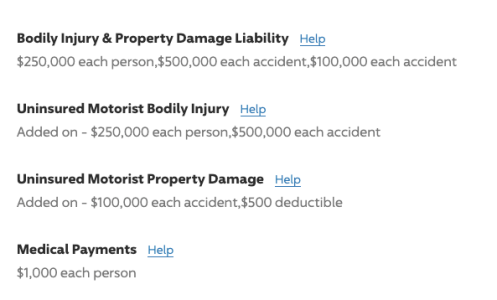

Today I switched from Horace Mann to Progressive and saved $900 a year on homeowners and $3600 a year on car insurance.

I tried to stay with Horace Mann, gave them multiple opportunities over the past 3 months to offer me lower rates, but like every insurance company I had to switch to get better rates.

If you have been with your same insurance provider for 4+ years it is time to switch. The insurance companies have no loyalty to you, you should not have any loyalty to them.

Today I switched from Horace Mann to Progressive and saved $900 a year on homeowners and $3600 a year on car insurance.

I tried to stay with Horace Mann, gave them multiple opportunities over the past 3 months to offer me lower rates, but like every insurance company I had to switch to get better rates.

If you have been with your same insurance provider for 4+ years it is time to switch. The insurance companies have no loyalty to you, you should not have any loyalty to them.