How much impact does a stripped vs full point contract change things? Example, many Aulani contracts are stripped until 2026 points. Compared to a contract with 2024 points.Something I want to do over the coming days/weeks is answer standalone questions using the methodology I've used in this thread.

Questions I've already come up with that I want to answer:

Some of these are trivially quick to answer, others require a bit more thought. Either way, I intend to give each question their own posts in this thread.

- Is Vero Beach decent for SAP at any price? Even free?

- How much extra should an OKW57 contract sell for vs. OKW42?

- How much extra should a subsidized Aulani contract sell for vs. non-subsidized?

- At what $/pt does Riviera resale become a very good deal? What about VDH? CFW?

I'd also be open to answering any standalone questions others have!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Most Economical Resort - Beyond Year 1

- Thread starter ehh

- Start date

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,517

Already tried answering that!How much impact does a stripped vs full point contract change things? Example, many Aulani contracts are stripped until 2026 points. Compared to a contract with 2024 points.

Value of Loaded and Stripped Contracts

Chili327

On the Boardwalk…

- Joined

- Feb 18, 2023

- Messages

- 5,033

If people are correct in thinking all OKW will get extended, then there really isn’t any difference in value. (but we’ll see how it actually pans out)Something I want to do over the coming days/weeks is answer standalone questions using the methodology I've used in this thread.

Questions I've already come up with that I want to answer:

Some of these are trivially quick to answer, others require a bit more thought. Either way, I intend to give each question their own posts in this thread.

- Is Vero Beach decent for SAP at any price? Even free?

- How much extra should an OKW57 contract sell for vs. OKW42?

- How much extra should a subsidized Aulani contract sell for vs. non-subsidized?

- At what $/pt does Riviera resale become a very good deal? What about VDH? CFW?

I'd also be open to answering any standalone questions others have!

Subsidized is just the dues difference per point, right? So just the amount you save pp.

My question is, CCV vs BLT, which is the better buy, longer contract or less dues?

Stripped vs loaded is just math, just determine what the price per point is and you add on or reduce the total. (maybe add in personal value if your planning a trip sooner than later?)How much impact does a stripped vs full point contract change things? Example, many Aulani contracts are stripped until 2026 points. Compared to a contract with 2024 points.

disneylandtour

DIS Veteran

- Joined

- Oct 7, 2006

- Messages

- 1,419

If people are correct in thinking all OKW will get extended, then there really isn’t any difference in value. (but we’ll see how it actually pans out)

----

To get this enforced will probably take an expensive legal battle--one in which 2042 owners might also lose. So the first question would be: is there a group of 2042 OWK owners who are willing to front the legal bill for this battle. And if not, I think that's the end of the story. And if there are a group then things get interesting. I sorta expect that when the price OWK 2042 starts to crash (maybe in five or so years), DVD will ROFR a bunch of cheap contracts, magically wash the points into 2057 contracts, resell them as a good profit, and further deplete the number of 2042 contract holders, meaning it will be even more difficult and more costly for the remaining 2042 owners to put together a legal case. But again, I could be wrong here.

disneylandtour

DIS Veteran

- Joined

- Oct 7, 2006

- Messages

- 1,419

PS Let me also add that I think the 2042/2057 issue, in terms of actual problems, is a red herring for OWK ownership. As an OWK owner (two contracts, both 2057), I think the big issue is going to be the high MFs. AKV has the value and club rooms which, for me, justify the higher MFs. But the MFs at OWK are starting to get a little painful compared to other WDW DVC options.

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,541

Personally, I think that's a fever dream. Disney is not going to roll over and give every OKW owner an extra 15 years at no cost beyond dues.If people are correct in thinking all OKW will get extended

Chili327

On the Boardwalk…

- Joined

- Feb 18, 2023

- Messages

- 5,033

I think you're right... but i guess we'll see what happens.Personally, I think that's a fever dream. Disney is not going to roll over and give every OKW owner an extra 15 years at no cost beyond dues.

I haven't read though the whole thread and I'm a little late to the game, but a significant factor of value of studios is to have a studio that sleeps five. When you have teen kids, they do not like to sleep in the same bed (and don't) so we always get the studios that sleep five. I'm sure this comes up later, reading on!All excellent points!

Despite *this thread and the work that goes into* I'm actually not a value purchaserWe buy for specific stays at specific resorts and, at this point, rarely book at 7m. And we lean into the high-points resorts, as when we do switch at 7m it means our 'buying power' is higher (and, occasionally, we get to stay somewhere special, like a GV or Cabungalow).

Last edited:

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

- Messages

- 8,739

Tatebeck

I Can G🤣 The DIS-tance

- Joined

- Dec 3, 2023

- Messages

- 2,468

They end up about the same I think even at $310. Just that the VDH lasts longer.@ehh , what’s better between now and 2060: VGC direct @$310pp or VDH direct @$205pp with the higher dues and TOT?

https://dvcfan.com/purchasing-dvc/is-disneyland-hotel-or-grand-californian-a-better-investment/

The key is to get lucky with a great deal on a VGC resale (225ish when available sometimes) or maybe hope for a VDH firesale in the future.

disneylandtour

DIS Veteran

- Joined

- Oct 7, 2006

- Messages

- 1,419

VGC is about a million times nicer than VDH. And none of the rooms look out on to bland suburban sprawl. $310 is expensive for VGC. But with the TOT, I'm not even sure that VDH is worth $50pp. If you include the TOT into the annual MFs (assuming you use all your points at VDH, the equivalent dues (MFs plus TOT) pp is about $4 higher than the MFs at GC. So maybe 26 years to the break even point for just simply buying the less attractive hotel at a lower buy in. If you own longer than that, you've lost money, assuming MFs raise equally and TOTs stay the same (which is unlikely).@ehh , what’s better between now and 2060: VGC direct @$310pp or VDH direct @$205pp with the higher dues and TOT?

Last edited:

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

- Messages

- 8,739

I know, I would just be interested in the math.VGC is about a million times nicer than VDH. And none of the rooms look out on to bland suburban sprawl.

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

- Messages

- 8,739

Take a look at DVCRofr.com and see who started the trend back in Dec 2022….They end up about the same I think even at $310. Just that the VDH lasts longer.

https://dvcfan.com/purchasing-dvc/is-disneyland-hotel-or-grand-californian-a-better-investment/

The key is to get lucky with a great deal on a VGC resale (225ish when available sometimes) or maybe hope for a VDH firesale in the future.

disneylandtour

DIS Veteran

- Joined

- Oct 7, 2006

- Messages

- 1,419

MFs plus TOT = a yearly cost of $20pp, assuming you use your VDH points at VDH. Over on the east coast, we're discussing whether VB has any sellable value with MFs at $14.30. Take that for what you will.I know, I would just be interested in the math.

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

- Messages

- 8,739

I get it.MFs plus TOT = a yearly cost of $20pp, assuming you use your VDH points at VDH. Over on the east coast, we're discussing whether VB has any sellable value with MFs at $14.30. Take that for what you will.

Given @ehh analytical skills… it’s more of a hypothetical. If your guide calls you and says they can get you direct VGC @$310 or VDH @$205 for 100 points…. which is the better deal through the end of VGC’s term given its $105pp initial deficit.

Tatebeck

I Can G🤣 The DIS-tance

- Joined

- Dec 3, 2023

- Messages

- 2,468

Nice! You got one too! lolTake a look at DVCRofr.com and see who started the trend back in Dec 2022….

It is definitely a no brainer for DL DVC if you can get VGC around the same price as VDH in my opinion. Better location, no TOT to pay at the time of stay. Just a bit shorter deed

Last edited:

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,517

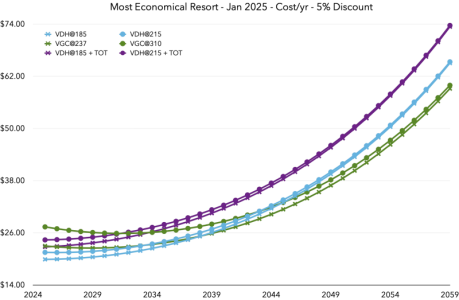

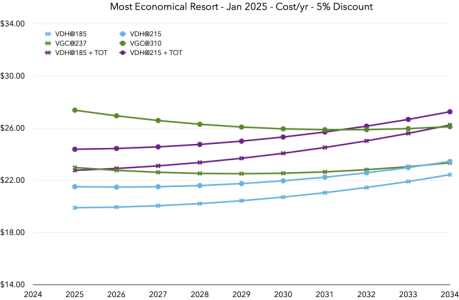

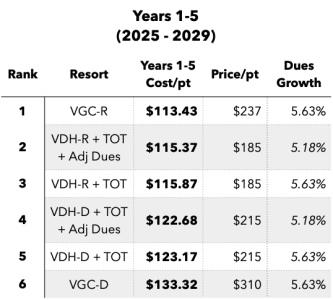

Now this is a fun experiment!@ehh , what’s better between now and 2060: VGC direct @$310pp or VDH direct @$205pp with the higher dues and TOT?

Some assumptions:

- Both VGC and VDH get the same dues growth rate (5.63%) as we have don't have enough VDH data yet to show it's different and VGC is VDH's only regional representation.

- VDH TOT increases at 3.2% every year. This is the amount it has increased every year to date and seems to be the agenda.

In the above charts, Direct gets dots and Resale gets Xs for line markers. VGC is green, VDH+TOT is purple, VDH (no TOT) is light blue.

Resale VGC costs less per point than resale VDH after TOT is factored in for all but the first year. And you can only use VDH points at VDH forever, so you're gonna pay that TOT.

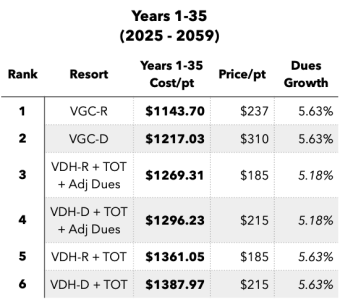

Direct VGC costs less per point than direct VDH with TOT factored in after year 7. The cumulative crossover is later, after year 14. By 2060, VGC is much lower--$1,217/pt vs. $1,387/pt.

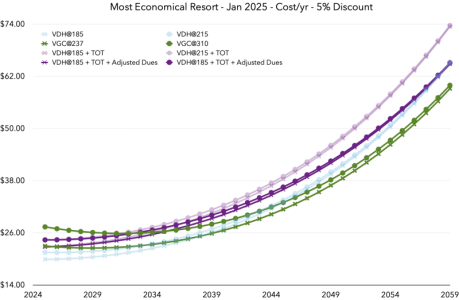

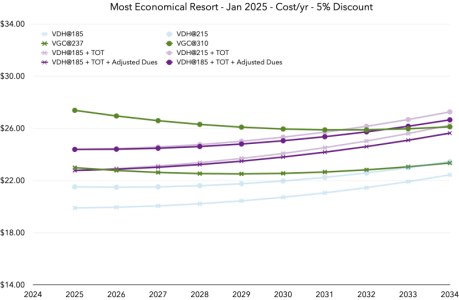

I think this is an underwhelming analysis, with a boring limitation: VDH has such little dues growth data that it has the same dues growth rate with my MER methodology. I thought this felt wrong, and I eventually realized why: I can at least compare the dues growth of VGC vs. VDH during their brief coexistence.

Compared to dues two years ago, the VGC dues growth has been 4.60% CAGR. VDH's has been 4.15% over the same time period. So what if we handicap the VDH dues growth by 0.45% and run it all again?

VGC Direct vs. VDH Direct yearly cost crossover is a year later in year 8, and the cumulative crossover isn't until 2041. VGC Direct still comes out ahead by a solid margin by 2060: $1,217/pt vs. $1,296/pt, about a 6% win

Let's look at the tables:

By the end of the VGC contract, VGC Direct comes out ahead of even VDH Resale...in this analysis at least. The odds that the dues growth in this analysis reflects what happens over the next 10 years is very low, let alone 17 or 35 years.

What about factoring in the points charts? Well, it doesn't change a lot when looking at VGC vs. VDH-Preferred View, a few percentage points here and there. The only meaningful difference in full-year points charts comparing VDH to VGC are:

- All the Duos, as there are none at VGC

- Standard View Deluxe Studios, where VDH has a 12% discount vs. VGC Studios (across the entire year)

- 1 Bedrooms, where VDH has an 11% discount vs. VGC 1BR (across the entire year)

Right now the points charts seasons are very much out sync when comparing VDH to VGC, so you're more likely to find efficiencies by constrasting the points charts than by anything else (at least for as long as the points charts seasons are this way).

Anyway, to wrap up, VGC Direct @ $310/pt does beat out VDH Direct @ $215/pt after factoring in TOT! ...but only eventually and only if you don't stay in a 1BR, Duo, or SV Deluxe Studio at VDH.

Thanks for the fun experiment suggestion!

(n.b., I didn't realize until after I did all this that you asked for VDH at $205 vs. my standard $215...it barely changes anything, the 2060 cumulative drops from $1,296 to $1,286, big whoop)

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

- Messages

- 8,739

Ok, so….. how low of an upfront ppp would VDH-R+TOT+Adj Dues need to be to be equal to VGC-R @ $225pp over 35 years?Now this is a fun experiment!

Some assumptions:

Okay, so what does it look like?

- Both VGC and VDH get the same dues growth rate (5.63%) as we have don't have enough VDH data yet to show it's different and VGC is VDH's only regional representation.

- VDH TOT increases at 3.2% every year. This is the amount it has increased every year to date and seems to be the agenda.

View attachment 932613

View attachment 932614

In the above charts, Direct gets dots and Resale gets Xs for line markers. VGC is green, VDH+TOT is purple, VDH (no TOT) is light blue.

Resale VGC costs less per point than resale VDH after TOT is factored in for all but the first year. And you can only use VDH points at VDH forever, so you're gonna pay that TOT.

Direct VGC costs less per point than direct VDH with TOT factored in after year 7. The cumulative crossover is later, after year 14. By 2060, VGC is much lower--$1,217/pt vs. $1,387/pt.

I think this is an underwhelming analysis, with a boring limitation: VDH has such little dues growth data that it has the same dues growth rate with my MER methodology. I thought this felt wrong, and I eventually realized why: I can at least compare the dues growth of VGC vs. VDH during their brief coexistence.

Compared to dues two years ago, the VGC dues growth has been 4.60% CAGR. VDH's has been 4.15% over the same time period. So what if we handicap the VDH dues growth by 0.45% and run it all again?

View attachment 932632

View attachment 932633

VGC Direct vs. VDH Direct yearly cost crossover is a year later in year 8, and the cumulative crossover isn't until 2041. VGC Direct still comes out ahead by a solid margin by 2060: $1,217/pt vs. $1,296/pt, about a 6% win

Let's look at the tables:

View attachment 932651

View attachment 932652

View attachment 932653

View attachment 932654

By the end of the VGC contract, VGC Direct comes out ahead of even VDH Resale...in this analysis at least. The odds that the dues growth in this analysis reflects what happens over the next 10 years is very low, let alone 17 or 35 years.

What about factoring in the points charts? Well, it doesn't change a lot when looking at VGC vs. VDH-Preferred View, a few percentage points here and there. The only meaningful difference in full-year points charts comparing VDH to VGC are:

If SV Deluxe Studios and 1BR are the rooms you want, then their 11-12% points chart discount flips the win to VDH-D+TOT+AdjDues by around a 6% margin.

- All the Duos, as there are none at VGC

- Standard View Deluxe Studios, where VDH has a 12% discount vs. VGC Studios (across the entire year)

- 1 Bedrooms, where VDH has an 11% discount vs. VGC 1BR (across the entire year)

Right now the points charts seasons are very much out sync when comparing VDH to VGC, so you're more likely to find efficiencies by constrasting the points charts than by anything else (at least for as long as the points charts seasons are this way).

Anyway, to wrap up, VGC Direct @ $310/pt does beat out VDH Direct @ $215/pt after factoring in TOT! ...but only eventually and only if you don't stay in a 1BR, Duo, or SV Deluxe Studio at VDH.

Thanks for the fun experiment suggestion!

(n.b., I didn't realize until after I did all this that you asked for VDH at $205 vs. my standard $215...it barely changes anything, the 2060 cumulative drops from $1,296 to $1,286, big whoop)

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,517

$47-48/pt, basically current Vero prices.Ok, so….. how low of an upfront ppp would VDH-R+TOT+Adj Dues need to be to be equal to VGC-R @ $225pp over 35 years?

Chili327

On the Boardwalk…

- Joined

- Feb 18, 2023

- Messages

- 5,033

Ok, so….. how low of an upfront ppp would VDH-R+TOT+Adj Dues need to be to be equal to VGC-R @ $225pp over 35 years?

Oh wow. lol$47-48/pt, basically current Vero prices.

-

Cool KIDS' SUMMER Returns to Walt Disney World in 2026: What to Know & How to Save

-

New Disney Merch: First Drop of 2026 with Park Maps Series

-

FREE Water Park Dates Return to Disney World This Summer

-

4 Reasons to Visit EPCOT for Festival of the Arts

-

New Year's Diet Resolution & Disney Vacation? Totally Doable

-

New FANDROP Figure Sets for Collectors Just Dropped

-

Add New Character Magic Shots to Your Magic Kingdom Day

New Threads

- Replies

- 0

- Views

- 39

- Replies

- 3

- Views

- 59

- Replies

- 4

- Views

- 102

New Posts

- Replies

- 122

- Views

- 52K

- Replies

- 57

- Views

- 6K

- Replies

- 4

- Views

- 102

- Replies

- 10K

- Views

- 1M

- Replies

- 70

- Views

- 4K