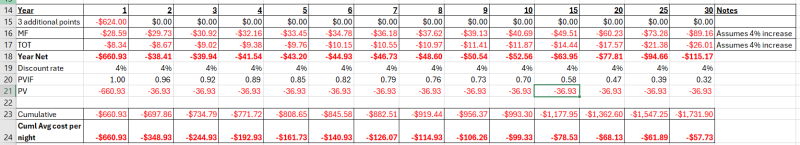

Ok, so by that logic 23 points is $368 and 26 points is $416… and includes parking.

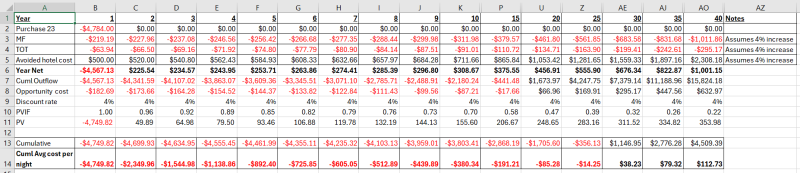

But wait…. those 23 points cost you $208pp…$4784 upfront… so using a RFOR of 4% = an additional $191….so the VDH SV is $559….

26 points = $632….

Current cash price for DLH Standard View hotel room + tax on the same night in August is $593 + $40 for parking so $633…

and sometimes (though generally not when we can travel) there are rack rate discounts in the hotel side….

Westin, 2 queens, no view for the same night is $526 with tax + $35 for self park… so $561…

Of course, part of the value of

DVC is that over time you’ve long forgotten your DVC buy in and only have the $11.50ish (adjusted for inflation) in dues and TOT on those 23 points… so it feels like $264 a night with Disney math.