BrianLo

DIS Veteran

- Joined

- Mar 29, 2019

- Messages

- 523

https://dvcnews.com/dvc-program-men...ation-club-direct-sales-fall-in-november-2024

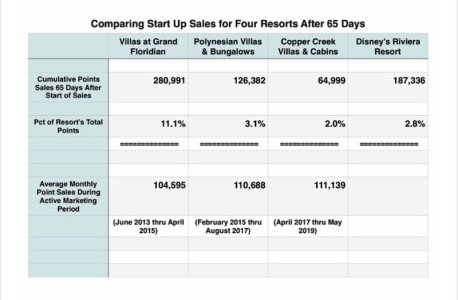

@maui22 has been tracking this well for us already. I think we’re seeing clear evidence Poly is overpriced.

RIV (on sale 27th of the prior month)

59k* / 129k / 114k

VGF2 (on sale the 3rd of the month/March 31 new members)

115k / 175k / 100k

VDH (on sale the 2nd of the month/30th new members)

145k / 162k / 94k

PIT (on sale 1st of the month/29th new members)

73k / 89k / December sales pending

*Note 169k of copper creek was also sold in the opening month of RIV.

@maui22 has been tracking this well for us already. I think we’re seeing clear evidence Poly is overpriced.

RIV (on sale 27th of the prior month)

59k* / 129k / 114k

VGF2 (on sale the 3rd of the month/March 31 new members)

115k / 175k / 100k

VDH (on sale the 2nd of the month/30th new members)

145k / 162k / 94k

PIT (on sale 1st of the month/29th new members)

73k / 89k / December sales pending

*Note 169k of copper creek was also sold in the opening month of RIV.