BrianLo

DIS Veteran

- Joined

- Mar 29, 2019

- Messages

- 523

So basically the unspoken secret that the second ROFR monster is actually DVCRM.

I’m also a bit surprised to learn their 7 month window is 14$. What do they charge renters in that window?

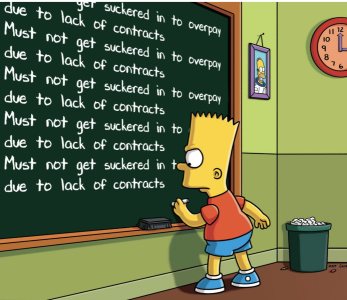

Nothing illegal, but they both are under representing sellers interests and driving up the resale market by stripping value out of contracts if this is a common maneuver.

I’m also a bit surprised to learn their 7 month window is 14$. What do they charge renters in that window?

Nothing illegal, but they both are under representing sellers interests and driving up the resale market by stripping value out of contracts if this is a common maneuver.