I'm in Colorado and can tell you my experience. I may also be able to guess which mountain pass you're talking about because I've probably driven that pass.

It has been about 5-7 years so laws may have changed a bit. And like someone has said, the terms and conditions of your policy my require more than the state law does.

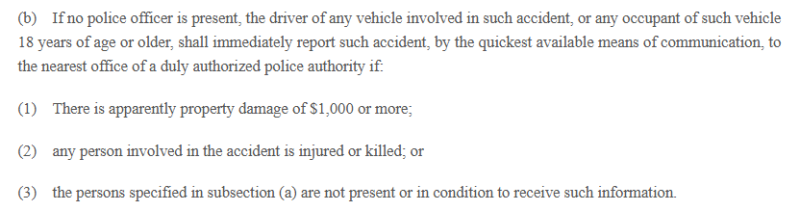

In Colorado you must report accidents immediately that involve injuries, death, or more than $1000 worth of damage. If not, you can be ticketed for leaving the scene of the accident, even if you report it the next day. If the accident did not meet these criteria, you have 60 days to report (may be 90 days). If the accident occurred during an accident alert in place, you have 24 hours to report the accident.

An example on reporting in CO, my car was hit in the parking lot of the pool we were getting ready to open at the beginning of the summer. It was a cashier who hit my car and one of my former students, so I knew him and his grandmother well. He had no insurance. There was no working phone at the pool yet and it was before cell phones, so I had to go to another location to report the accident and then go back to the location of the accident. Even though it was less than 2 hours, the officer told me he could write me a ticket for leaving the scene even though I did not cause the accident. This law has not changed so they may issue tickets to both drivers for leaving the scene for a reportable accident.

The person who hit your daughter would have also been ticketed for not having tires for the driving conditions. During the winter, snow tires or all-season tires are required for mountain driving, and you can be stopped and ticketed if you do not have them. You will receive a ticket if you are involved in an accident if you do not have the correct tires, even if you are not at fault.

One year I had 3 claims totally over $13,000 on my car and my rates never went up because I was not at fault. 1 was hail damage, 1 was an uninsured driver, the other was from a stolen ATV that was fleeing the scene of the crime. My insurance company did send me a thank you card when I sold this car.