I now use MasterCard through my bank, and I'm happy with the currency conversion rates. My previous bank used Visa, which had much worse rates. That was actually the main reason I switched banks—too many trips to Disney World. I think the switch saved me at least $200–$300 a year.

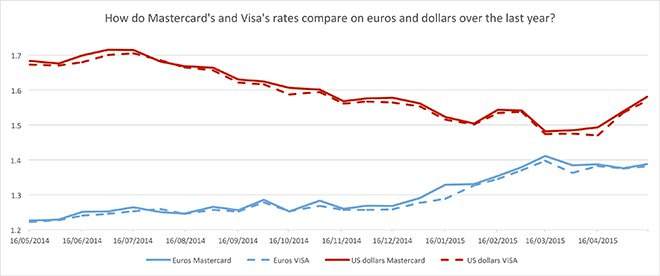

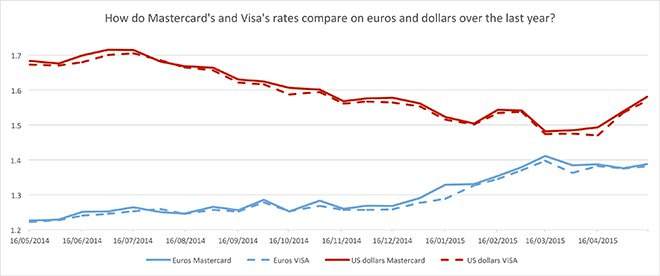

it has been shown that Visa usually has a worse exchange rate. Normally there is a difference of 0.6% in the exchange rate between the card issuers.

Average differences between exchange rates are small. In the weekly comparison, MasterCard’s average rates were generally more favorable for U.S. consumers than Visa rates, but usually by less than 1%.

I tried other cards with no fees, but their currency exchange rates weren’t as good as my MasterCard (I havent tried Revolut).

So, if you're considering Revolut (or any other 'free' travel credit card), make sure the exchange rate is competitive, and that there are no hidden fees. For example, in Sweden, Revolut has a $1,000 limit, after which they charge an additional 0.5%. You can also only withdraw $200 in cash without fees, and the currency spread tends to be higher on weekends. Additionally, some banks seem to blacklist Revolut users because it's often associated with cryptocurrency purchases.

That said, it’s probably a good idea to have a backup card just in case something goes wrong. Let us know what you end up going with!

it has been shown that Visa usually has a worse exchange rate. Normally there is a difference of 0.6% in the exchange rate between the card issuers.

Average differences between exchange rates are small. In the weekly comparison, MasterCard’s average rates were generally more favorable for U.S. consumers than Visa rates, but usually by less than 1%.

I tried other cards with no fees, but their currency exchange rates weren’t as good as my MasterCard (I havent tried Revolut).

So, if you're considering Revolut (or any other 'free' travel credit card), make sure the exchange rate is competitive, and that there are no hidden fees. For example, in Sweden, Revolut has a $1,000 limit, after which they charge an additional 0.5%. You can also only withdraw $200 in cash without fees, and the currency spread tends to be higher on weekends. Additionally, some banks seem to blacklist Revolut users because it's often associated with cryptocurrency purchases.

That said, it’s probably a good idea to have a backup card just in case something goes wrong. Let us know what you end up going with!