CastAStone

Business nerd. Good at math. Bad at spelling.

- Joined

- Jun 25, 2019

- Messages

- 5,988

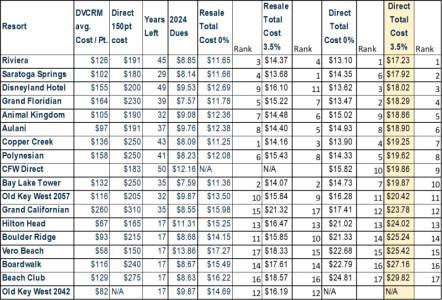

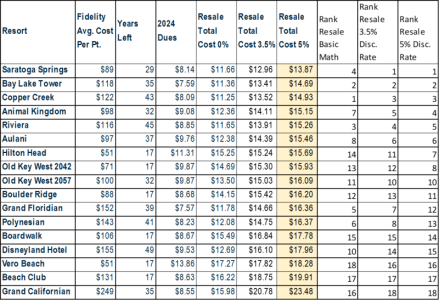

A few years ago I posted a thread on dues per room night. If someone wanted to recreate this with the total cost of ownership it wouldn’t be a terribly difficult excel exercise.

I posted a DVC dues summary on another thread and it was suggested I pull together a separate thread on the topic. This is that thread.

I've also posted dues charts - points charts, but with dues instead of points. The use of points kind of obfuscates actual costs, and if you think you will be somewhat consistent in your travel schedule, hopefully this will help you compare costs across resorts.

I am using the 2021 Points Charts, because the 2020 ones at this point really have very little utility, but 2020 Dues, because that's the most recent dues we have. As they are announced I plan to update this with 2021 dues.

Let me know thoughts on improvements or other information.