Monthly update!

Hopefully this is my most delayed monthly update, I was busy cruising and using DVC points the last couple of weeks (note: those are separate events) and that's why this update is so late into the month.

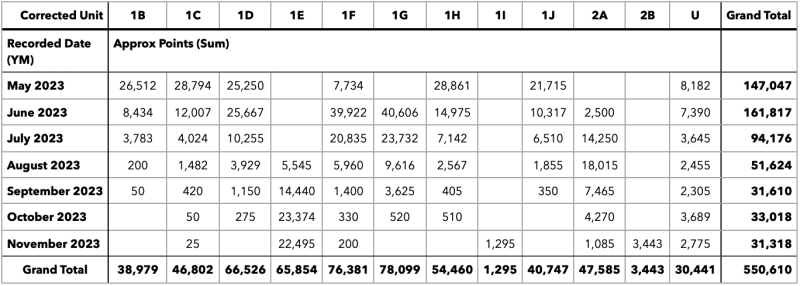

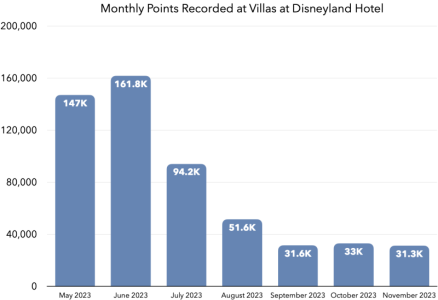

Total points recorded as of November 30th:

~551k points (16.9% of all points).

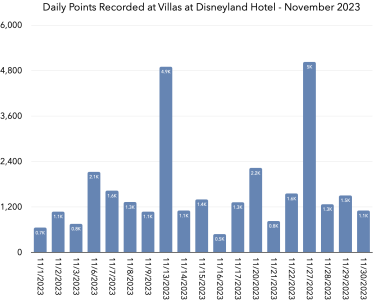

Points recorded in November:

~31.3k points.

November sales were almost perfectly inline with September and October. September sales were 31.6k and October was 33k.

At the current rate, VDH will sell out in a whopping 86 months, roughly late 2030!

Despite this, DVC hasn't ramped up incentives at all, despite the opportunity to include VDH in the recent RIV incentive boost.

As I've detailed in the past, there is a potential rationale for keeping this sluggish sales pace: they already booked the rooms on cash and can't add inventory via declarations before 2024.

Currently ~22.3% of points are declared and at least ~17% of the resort has been sold. That leaves just ~5.3% of headroom, roughly 176k points, before more Units must be declared. At the current sales rate of ~7.2k/wk, that's just 24 weeks from the end of November, which works out to May 2024.

My thinking here could be completely unfounded, but considering they started renting rooms on cash prior to any sales starting, they may have heavily relied on their sales forecasts to determine how much inventory they could rent. That forecast is in the POS and it's the current level of declarations, 'just' 22.3% of points.

I think initial sales were faster than they expected and they've needed to pump the brakes a bit and are perfectly happy at this sales pace until 2024, which had a much later release of cash rooms.

I also have a new theory brewing, from the recent revelation of a Trust being registered: they're happy to sell a trickle of points now without big incentives, in anticipation of including as much VDH as possible in the Trust.

As a reminder, I'm just doing ad hoc and monthly updates now.

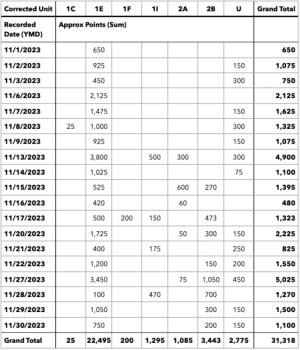

Fun facts about November's sales:

Nothing remarkable about mega-contracts, just one 800pt contract at the top of the pile.

Unit 1E was the top seller again, roughly 72% of all sales this month, roughly 6.5x 2nd most (2B).

Units 1I (one eye) and 2B made their first appearances!

There was one potential Favorite Week contract, a 173 point contract that could be a FW in a PV Deluxe Studio in Week 21. It's possible I'm overcorrecting some of the tax values posted and missing other FW. If anyone wants me to explain this, I can, but it's very inside baseball for this.

It is likely that a bunch of Units are now sold out: 1B, 1C, 1D, 1F, 1G, 1H, and maybe 1J. We still haven't seen 1A show up in any recorded deeds yet. I'm also not sure how many Units are in Phase 2, but we've only seen Unit 2A and Unit 2B from Phase 2 so far, but I suspect there's at least 2C, possibly also 2D.

Other interesting facts about the contracts recorded in November:

- 190 contracts recorded

- 71x 150pt contracts (71 the prior month)

- 30x 200pt contracts (24 the prior month)

- 22x 100pt contracts (22 the prior month)

- 18x 50pt contracts (24 the prior month)

- 18x 250pt contracts (13 the prior month)

- 8x 300pt contracts (6 the prior month)

- 23x other contracts (36 the prior month)

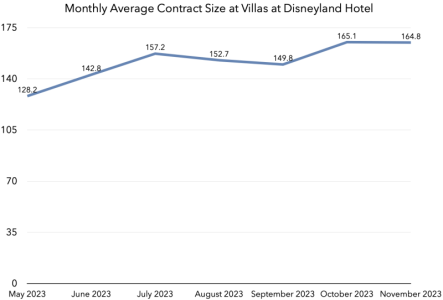

- 164.8pt average contract size in November

- May had an average of 128.2pt

- June had an average of 142.8pt

- July had an average of 157.2pt

- August had an average of 152.7pt

- September had an average of 149.8pt

- October had an average of 165.1pt

- 800pt is largest contract in November

- 25pt is smallest contract

- 300pt is the largest contract size purchased multiple times (8x)

- Unit 1E was assigned the most (22.5k, 2nd most was 2B at 3.4k)

Points recorded by date:

View attachment 817181

"U" unit stands for "Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

View attachment 817182

Points recorded by month:

View attachment 817180

View attachment 817178

View attachment 817179

lol. Ouch! but you only get to do your first trip to

lol. Ouch! but you only get to do your first trip to