A few years back I looked at the dues breakdown of the 2 resorts we own, BW and VGF.

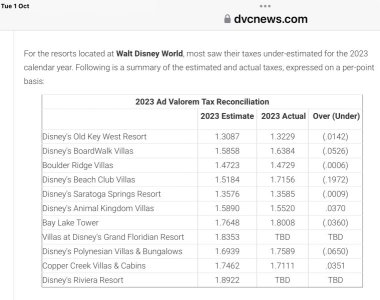

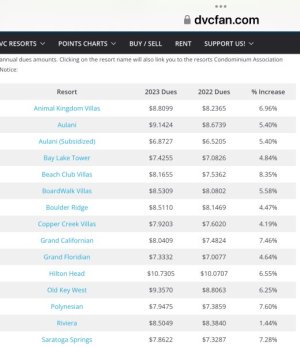

BW paid $1.5858 ad valorem taxes as part of $8.53 dues, and VGF paid $1.8353 as part of $7.33 dues. BW’s were ~19% of the dues and VGF’s were ~25% of dues, which didn’t seem like a big difference until I considered the average point cost per night, which VGF uses about 50% more points.

Altogether that made VGF’s ad valorem taxes almost twice the cost/nt for a than BW on average when comparing same room size.

Guess that’s why they were contested? I can see VGF with a higher valuation and the rooms generally have a little more square footage and whatever else the valuation covers… maybe swanky materials, more amenities and their sf, etc? But roughly double the tax per night? That seemed excessive.

View attachment 899747

View attachment 899748