You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ROFR Thread April to June 2024 *PLEASE SEE FIRST POST FOR INSTRUCTIONS & FORMATTING TOOL*

- Thread starter pangyal

- Start date

DonMacGregor

Sub Leader

- Joined

- May 13, 2021

It was apparently a https://*******.com (site address blocked by filter) contract that was confirmed on that site's Facebook page by the broker. I can't say who it was, but I think simply saying it was actually confirmed by one of the larger players in the market should be safe. At least I can confirm it wasn't a rumor.Details needed

Chili327

DIS Veteran

- Joined

- Feb 18, 2023

And seller pays the dues. lolIt is such an @Jimmy Geppetto move to pass ROFR with a fire sale deal on a loaded contract on a day when ROFR decided it was going to be a resale Red Wedding.

wilkydelts

Be Realistic, Be Happy

- Joined

- Oct 29, 2017

@Jimmy Geppetto was 5/2 so two weeks before any of the activities today. It does not even relate.

CastAStone

Math and business nerd. Not an insider.

- Joined

- Jun 25, 2019

Paul, several members here have noted that they were told by their guides this week that they have run out of or are about to run out of OKW points. Your write up makes it sound like DVC’s objective was to set a price floor; it seems pretty evident though that they just don’t have any more points.GRAND FLORIDIAN HAS JOINED THE PARTY! Blog is updated:

https://www.dvcresalemarket.com/blog/dvc-expands-rofr-buybacks-to-old-key-west-resort/

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

pssst…don’t let facts get in the way of a good story@Jimmy Geppetto was 5/2 so two weeks before any of the activities today. It does not even relate.

CastAStone

Math and business nerd. Not an insider.

- Joined

- Jun 25, 2019

I don’t think the poster was saying that they do, like at all.@Jimmy Geppetto was 5/2 so two weeks before any of the activities today. It does not even relate.

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

I have always been surprised they didn’t ROFR up all of the non-Intl seller Subsidized contractsIt was apparently a https://*******.com (site address blocked by filter) contract that was confirmed on that site's Facebook page by the broker. I can't say who it was, but I think simply saying it was actually confirmed by one of the larger players in the market should be safe. At least I can confirm it wasn't a rumor.

DVChris

Mouseketeer

- Joined

- Jun 10, 2021

Did they post any details on the contract? Subsidized? Crazy low price? So strange why they would ROFR Aulani.It was apparently a https://*******.com (site address blocked by filter) contract that was confirmed on that site's Facebook page by the broker. I can't say who it was, but I think simply saying it was actually confirmed by one of the larger players in the market should be safe. At least I can confirm it wasn't a rumor.

In general I agree with you that DVC is overpriced... however, I think in this case the rhyme and reason is pretty clear:Called it months ago. ROFR would make an appearance to scare the market, no rhyme nor reason, and then fizzle away. Let the panic buying ensue.

I’ll hold out for the DVC point glut 7-8 months out.

OKW - DVC has so much strategic interest to reacquire nearly all of these contracts. Add in great sales right now where they can double their money on these ROFR prices and it makes sense...

Poly - new tower coming and they want to prop up prices/discourage resale

VGF - trying to build up points here plus it is a nice "check" on the poly tower which could arguably have been called VGF3....

AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

Are things really “overpriced” or have we not accepted that there was a lot of inflation over the last 4 years that will not be going back down?In general I agree with you that DVC is overpriced... however, I think in this case the rhyme and reason is pretty clear:

OKW - DVC has so much strategic interest to reacquire nearly all of these contracts. Add in great sales right now where they can double their money on these ROFR prices and it makes sense...

Poly - new tower coming and they want to prop up prices/discourage resale

VGF - trying to build up points here plus it is a nice "check" on the poly tower which could arguably have been called VGF3....

We’ll know more in 10 years…

HyperspaceMountainPilot

DIS Veteran

- Joined

- Dec 23, 2019

I was also wondering if $239 direct is even that high in real dollars compared with whatever list price was in 2019, but was worried I might get run off this thread with a pitchfork for asking.Are things really “overpriced” or have we not accepted that there was a lot of inflation over the last 4 years that will not be going back down?

We’ll know more in 10 years…

TinkAgainU

Trust In The Pixie Dust

- Joined

- Dec 11, 2021

Makes sense - ROFR pushes the perceived value up (for a bit at least) ...Updated!

So it does seem that they are now limited ROFR activity to resorts in active or "just about to active" sales, rather than the stockpiling method they went for over the past few years.

HyperspaceMountainPilot

DIS Veteran

- Joined

- Dec 23, 2019

I’m sure it’s poor form to reply to your own post but I looked it up after @Genie+ helpfully provided pricing data from 2019, and it turns out that prevailing DVC “sticker” prices on Jan 2019 would be exactly $225 today (edit to add— adjusted for inflation).I was also wondering if $239 direct is even that high in real dollars compared with whatever list price was in 2019, but was worried I might get run off this thread with a pitchfork for asking.

CastAStone

Math and business nerd. Not an insider.

- Joined

- Jun 25, 2019

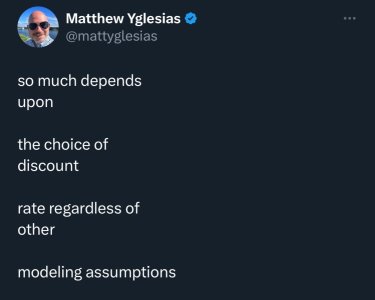

I think overpriced for DVC is not a calculation in absolute dollars, it’s just comparing it to the alternatives. It’s basically impossible to justify current DVC direct prices vs just paying cash or renting points for nearly all of the sold out resorts, as well as for people planning to stay mainly in 1 bedrooms at any resort. Certain times of year are also negative values, and CFW is upside down as well.Are things really “overpriced” or have we not accepted that there was a lot of inflation over the last 4 years that will not be going back down?

We’ll know more in 10 years…

Ultimately, though, most of whether a direct purchase is overpriced comes down to how much you value future money.

I looked up the launch price for OKW in 1992 and, after inflation….$116. Plus it came with like 7 years of free park tickets.I’m sure it’s poor form to reply to your own post but I looked it up after @Genie+ helpfully provided pricing data from 2019, and it turns out that prevailing DVC “sticker” prices on Jan 2019 would be exactly $225 today (edit to add— adjusted for inflation).

I can’t get over how much of an absolute steal early DVC was.

Genie+

You can never spend enough

- Joined

- May 12, 2022

I looked up the launch price for OKW in 1992 and, after inflation….$116. Plus it came with like 7 years of free park tickets.

I can’t get over how much of an absolute steal early DVC was.

Wow I would’ve expected it to be more over that amount of time - over 30 years.

OKW starting at $50-$60pp with 220 pt minimum - $11-$12k

I found this: For 1992, the average base price of a domestic Big Three car is $17,007

Ford Taurus was $18-20k.

The ~$2.50 dues back then only come to $5.60 in today’s dollars. They are actually close to $10 now.

intamin

Ready to go.

- Joined

- Nov 25, 2022

Can I pay you to negotiate on my behalf? Even though there’s no wiggle room since I’m only buying direct from here on out if anyone can swoon a DVC guide to lower the price it’s youJimmy Geppetto---$111-$20664-180-BLT-Jun-0/23, 322/24, 180/25-Seller pays 2024 MF- sent 4/22, passed 5/2

-

New Donald Duck + Disney Munchling Merch Coming to Disney Parks

-

5 Steps to Completing Your Character Autograph Book in the Disney Parks

-

See the Adorable New Light-Up Stitch Figurine!

-

Three Bridges Bar & Grill Disney World Dining Review

-

Special Pixar Speaker Series Available for Guests at Disneyland Hotels

GET A DISNEY VACATION QUOTE

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

New DISboards Threads

- Replies

- 0

- Views

- 49

- Replies

- 0

- Views

- 128

- Replies

- 0

- Views

- 150